Importing to Mexico Without a Local Entity: Why Foreign Shipments Get Stuck

For foreign companies, importing goods into Mexico often appears straightforward on paper, yet it remains one of the most failure-prone scenarios due to strict local-responsibility frameworks.

US, UK, EU, and international e-commerce brands regularly attempt to ship equipment, IT hardware, or commercial samples into Mexico using DDP or courier-based models—only to discover that customs deadlocks and regulatory flags are the norm when a local legal entity is missing.

Mexico’s Import System Is Built Around Local Accountability

Mexico does not treat imports as purely logistical movements. Every shipment is evaluated through fiscal responsibility (Tax ID / RFC), product-level regulatory compliance (NOM standards), and importer accountability at the port of entry.

It is important to note that foreign companies importing IT hardware to Mexico without a local entity often underestimate the strictness of these requirements. When a foreign company ships without a local presence, at least one of these core elements is inevitably missing, creating a gap where shipments become immovable.

The Most Common Triggers That Block Foreign Shipments in Mexico

NOM Safety and Energy Compliance (Including Refurbished Equipment)

Many foreign shippers assume that used or refurbished equipment falls outside Mexico’s compliance scope. This assumption is wrong. Network equipment, switches, routers, and similar devices—whether new, used, or refurbished—are commonly subject to NOM safety and energy efficiency regulations. Once NOM is triggered, certification is required, and retroactive fixes are rarely accepted.

Tax ID (RFC) Requirements for Foreign Importers

Mexican customs requires a locally registered RFC (Tax ID) tied to the importer assuming fiscal responsibility. This is where many DDP shipments collapse. Mexico customs clearance becomes especially complex for non-resident companies because, under DDP, sellers believe they are handling everything, but without a valid Mexican RFC, brokers cannot proceed and liability cannot be assigned.

Courier Entry Points and Accreditation Limitations

Courier choice matters far more than most companies realize. Each courier enters Mexico through specific customs points. If a shipment enters through a port where intervention or corrective procedures are not possible, the shipment is effectively locked.

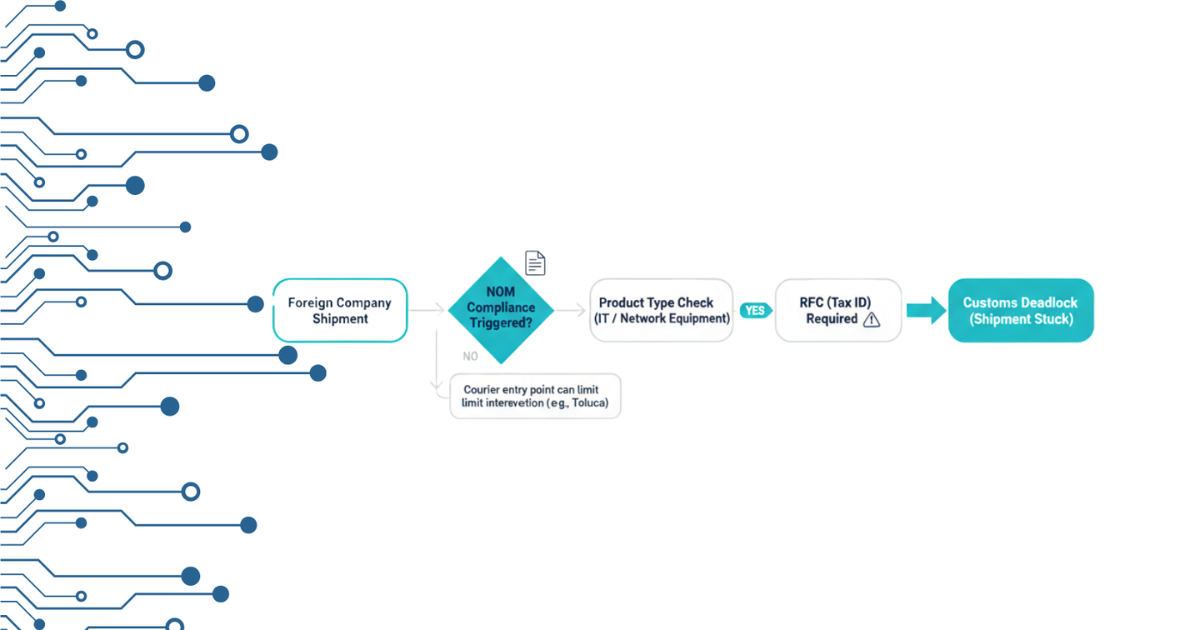

Visualizing the workflow and common failure points for non-entity imports.

Case Study — Refurbished Network Switch Shipment Held at Mexican Customs

Background: A foreign technology company attempted to ship a refurbished network switch for internal testing. The company had no Mexican legal entity and structured the shipment similarly to a DDP delivery. The shipment was stopped during the initial compliance review.

Compliance Issue Identified: Network switches are regulated electronic equipment. Despite being refurbished, the device required NOM safety and energy compliance. Applying full certification would have delayed the shipment significantly and created costs disproportionate to the value.

Resolution Paths Evaluated: The team analyzed simplified courier clearance (for non-commercial shipments under USD 2,500) via DHL or UPS. FedEx was deliberately avoided because all FedEx shipments enter through Toluca Customs, where procedural recovery is effectively impossible.

Outcome: A simplified courier import was selected. The shipment cleared customs compliantly without NOM certification and was delivered without further delay. For larger or recurring needs, companies typically require Importer of Record (IOR) solutions in Mexico to maintain control.

Importing to Mexico Without a Local Entity: What Actually Works

Foreign companies fail in Mexico not because their products are prohibited, but because the import structure is wrong. Success depends on understanding NOM trigger thresholds and aligning fiscal responsibility with customs reality.

When Simplified Courier Clearance Is Viable

This is typically reserved for low-value (under $2,500 USD), non-commercial shipments where certain international couriers can use a simplified declaration to bypass full NOM certification.

When a Formal Import Structure Becomes Necessary

For higher-value shipments or repeated operations, Importer of Record models in Mexico are often the only viable option for foreign companies. This structure allows for NOM exemptions or deferred compliance under controlled conditions that a standard courier cannot provide. You can explore more about Mexico Importer of Record for foreign companies to see how these frameworks mitigate risk.

Final Notes for Foreign Companies Shipping to Mexico

Mexico is not a “plug-and-play” import market. Once a shipment is flagged, options shrink fast. Compliance cannot be improvised, and courier choice can determine success or failure. For companies evaluating compliant alternatives to entity-based imports, structured Importer of Record (IOR) models provide a controlled and legally sound path forward.

Secure Your Mexico Tech Deployment

Don't let your hardware get stuck in customs. Connect with our Mexico trade specialists for a compliant IOR structure.

Contact Mexico Support